All about Personal Guarantee Lease

Safety and security deposits can be a major burden on lessees, especially startup renters that might not have accessibility to cash they can offer to the proprietor to hold for an extended period of time. When it is impractical (or difficult) to give the landlord adequate security with simply a down payment, the parties will certainly typically consider a letter of credit rating to either supplement or replace a protection down payment.

Essentially, it is a protection down payment in the kind of debt advanced by a 3rd event establishment (generally a bank). Letters of credit scores come in 2 significant kinds, business and standby. For objectives of business leasing, we are talking only concerning the standby letter of credit rating. The way the letter of debt jobs is that the tenant will certainly most likely to its lender and also request for a letter of credit report in favor of the property manager.

If the bank determines the renter is creditworthy, then the bank will provide a letter of credit history attesting the tenant. The letter of credit scores is usually actually a letter signed by the bank that says the financial institution will certainly provide a specific quantity of money to the proprietor if the property manager contacts the financial institution and also accredits that the tenant is in default.

Letters of credit are often discussed, both between the property owner and also renter and in between the occupant and the financial institution. Among the significant problems is whether the property owner will certainly need to provide any proof of actual lease default prior to the bank is required to pay on the letter of debt.

The Best Strategy To Use For Breaking Commercial Lease Personal Guarantee

As well as the tenant would favor the bank ask concerns prior to turning over the cash. You need to comprehend what your property owner has to perform in order to gain access to the t of credit, including whether the proprietor must first seek settlement from other resources. Additionally, since a letter of credit can be costly (typically a couple of percent of the equilibrium each year just to keep the letter effective), the renter will certainly intend to take into consideration replacing the letter of credit scores as quickly as the proprietor agrees to let it go.

A letter of credit report can be a really helpful device for proprietors as well as occupants to endanger pertaining to credit reliability, as well as they are utilized frequently, particularly in bigger transactions where the expense of the letter of credit is much more quickly soaked up. You need to understand whether a letter of credit scores will benefit you, what other alternatives may be offered, as well as the details regards to the letter of credit rating, prior to consenting to provide one.

An individual guarantee (additionally written as "personal guaranty") is another usual kind of credit history enhancement. It is an assurance by several people that a 3rd party occupant (usually the minimal obligation entity where the individuals are transacting service) will certainly pay according to the regards to the lease.

An individual guarantee can be a powerful type of credit scores improvement and also is an additional device made use of to supplement (but normally not change) a protection deposit. Individual assurances prevail when the renter is a restricted liability entity, such as an LLC, without a recognized operating background and without significant possessions - personal guarantee commercial lease.

Not known Facts About Breaking Commercial Lease Personal Guarantee

Due to the fact that of this, property owners will often require that minimal obligation entity owners directly ensure the lease commitments. The personal guarantee is similar to the letter of credit report in that it provides the landlord much more certainty of being paid in case the renter is incapable or resistant to put up a big enough safety down payment to make the property owner comfortable.

The terms of an individual assurance commonly differ, as well as the more greatly bargained terms surround whether the property manager needs to first go after the lessee prior to going after the individual guarantor. Commonly, the proprietor wants the alternative to go after the individual guarantor without having actually already pursued the tenant, where an individual guarantor desires the opposite.

You must fully recognize the personal guarantee prior to signing, as authorizing an individual assurance significantly undermines the function of having a minimal liability entity as well as reveals the personal guarantor to considerable individual risk. breaking commercial lease personal guarantee. Image: p_d_s Flickr Gideon has actually fly fished for trout in rivers on 3 continents.

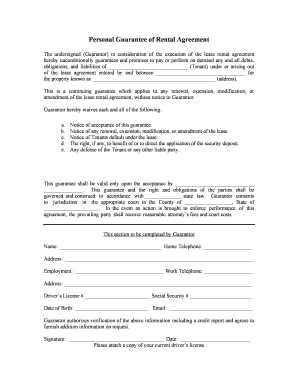

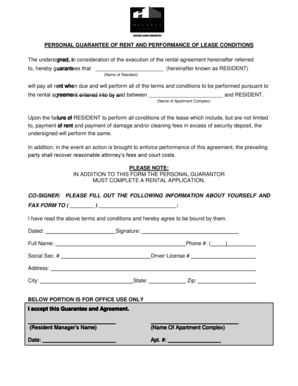

Show information Conceal details ARRANGEMENT OF PERSONAL WARRANTY ATTACHED TO As Well As MADE PART OF THE LEASE AGREEMENT DATED 20 BETWEEN PROPERTY OWNER AND OCCUPANT The undersigned Guarantor in consideration of the production of the foregoing Lease Contract between Lessee and Landlord does hereby unconditionally guarantee the repayment of the lease by the Tenant and the performance by Lessee of all the economic obligations and also obligations under the Lease Arrangement.

5 Easy Facts About Personal Guarantee Lease Explained

In my 35 years of experience as an entrepreneur as well as lease mediator for business America as well as local business owners, the most common component for most small company proprietors when signing a lease is the personal guaranty vs. a corporate warranty for large corporations. I'm frequently asked by local business owner if the individual warranty can be omitted when signing a lease. how to get out of a personal guarantee on a commercial lease.

There are a couple of exceptions when an industrial proprietor will accept a letter of credit scores or other considerable collateral in lieu of the warranty, yet 99% of the moment, an individual guaranty can not be avoided. There are many factors for this need (breaking commercial lease personal guarantee). First, the proprietor wants assurances the lease responsibilities will certainly be satisfied by the local business owner, and as a motivation, they desire the lease backed by the individual guaranty, therefore, making it a lot more tough for the service owner to just leave the lease if the company is refraining well or along with anticipated.

There are, nonetheless, some techniques to bargain these individual assurances that can be utilized in leasing purchases. The most advised method is to make use of a restricted or rolling warranty. These techniques are sometimes appropriate to proprietors, depending upon the company owners' credit, monetary photo and also organisation experience. The more powerful the qualifications, the far better odds of being able to work out.

click over here